nebraska inheritance tax calculator

Its important to note that some. 45 In fact one study found that a 1.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Overall Nebraska Tax Picture.

. That means they are taxed at the rates. REG-17-001 Scope Application and Valuations. To estimate your tax return for 202223 please select the 2022.

How is this changed by LB310. Suite 200 Lincoln NE. 00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other interest in trust or otherwise having.

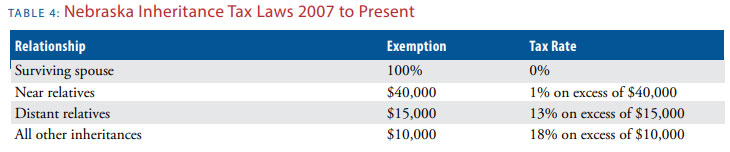

A person gives away 2000000 in their lifetime and dies in 2022 and is entitled to an individual federal estate tax exemption of 12060000. Nebraska income tax brackets range from 246 to 684nebraska uses a progressive tax rate system meaning that higher levels of income are taxed at higher rates. 1 on any value over 40000.

The Nebraska inheritance tax applies to persons who die while residents. Aunts uncles nieces nephews and any spousesdescendants. How is this changed by LB310.

The Nebraska inheritance tax applies to all property including life insurance proceeds paid to the estate. What is inheritance tax do you pay in Nebraska. Their federal estate tax exemption is.

Anything above 10000 in value is subject to a 18 inheritance tax. Like most other states except for Alaska Delaware Montana New Hampshire and Oregon Nebraska charges a sales tax on most goods and services. Brian and Joe as Class 1 beneficiaries will pay a 1 percent tax on 160000 less applicable deductions 200000 40000 exemption.

Currently the first 10000 of the inheritance is not taxed. The burden of paying Nebraskas inheritance tax ultimately falls upon those who inherit the property not the estate. Currently the first 10000 of the inheritance is not taxed.

The Nebraska State Tax Calculator NES Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223. Anything above 15000 in value is subject to a 13. Nebraska State Bar Association 635 S.

Nebraska currently has the nations top inheritance tax rate 18 on remote relatives and non-related heirs. 402 475-7091 Toll Free 800 927-0117 Fax 402 475-7098. Nebraska Capital Gains Tax.

Long- and short-term capital gains are included as regular income on your Nebraska income tax return. The exempt amount is. The state fully taxes withdrawals from retirement accounts like 401k plans and income from.

Nebraska is a not a tax-friendly state for retirees. The Nebraska State Tax Calculator NES Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223. Anything above 10000 in value is subject to a 18 inheritance tax.

There have been many academic studies that have found evidence that high state inheritance taxes discourage migration into a state. Parents siblings children grandparents and any spousesdescendants of these relatives. Beneficiaries inheriting property pay an inheritance tax over.

Although Nebraska no longer has an estate tax it is one of seven states that imposes a separate state inheritance tax. Determine the property subject to tax and the value thereof. Bob a Class 2.

What Is The Estate Tax In The United States The Ascent By The Motley Fool

Estate Taxes Who Pays The Bill

Nebraska Estate Tax Everything You Need To Know Smartasset

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Is There An Inheritance Tax In The Usa Expat Tax Professionals

How To Calculate Inheritance Tax 12 Steps With Pictures

Estate And Inheritance Taxes By State In 2021 The Motley Fool

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Inheritance Tax How Much Is It What To Expect Full Guide

Nebraska Income Tax Ne State Tax Calculator Community Tax

Tax On Farm Estates And Inherited Gains Farmdoc Daily

Nebraska Income Tax Ne State Tax Calculator Community Tax

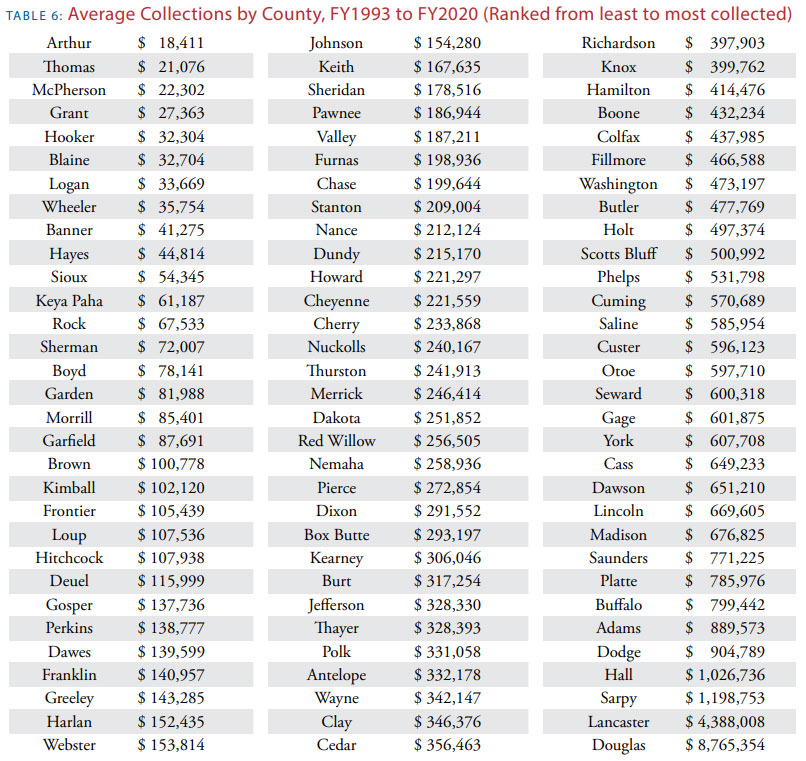

Death And Taxes Nebraska S Inheritance Tax

Death And Taxes Nebraska S Inheritance Tax

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

Do I Need To Pay Inheritance Taxes Postic Bates P C

Nebraska Income Tax Ne State Tax Calculator Community Tax

:max_bytes(150000):strip_icc()/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)