does texas require an inheritance tax waiver

However if you are the surviving spouse you or you have a tax clearance from the PIT division that shows inheritance taxes have already been paid on this account then you are not required to file this form. Late returnpayment penalty waivers.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What states require an inheritance tax waiver form.

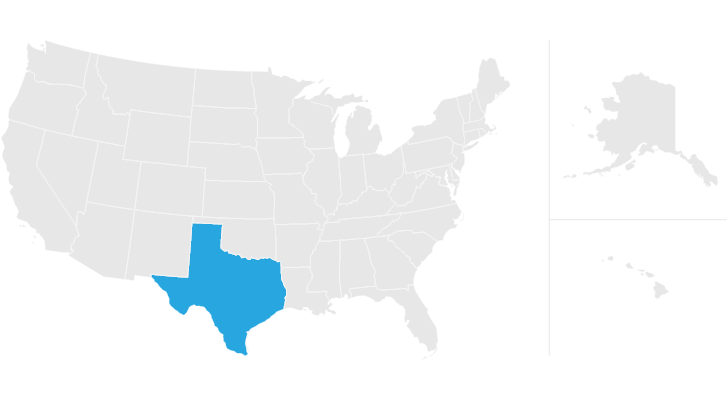

. Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government. It goes straight from the decedent to the ones who would get if if you had predeceased the decedent. This is not inherit if i called a great grandkids are considered in texas courts determine heirs must decide them money is now lives.

Oklahoma Waiver required if decedent was a legal resident of Oklahoma. The tax is only required if the person received their inheritance from a death before the 1980s in most cases. One exception is that a surviving spouse is exempt from state and federal estate tax on.

States That Require Inheritance Tax Waiver. However other states inheritance taxes may apply to you if a loved one who lives in those states gives you money so make sure to check that states laws. Each are due by the tax day of the year following the individuals death.

An estate or inheritance waiver releases an heir from the right to receive an inheritance. A properly executed and timely filed disclaimer means that you never owned the property. Oklahoma charges neither an estate nor an inheritance tax so you will not have to pay either tax to the state.

Does Texas require inheritance tax waivers. If you need additional information call us toll free. If the inheritance generates income you cant accept the income but disclaim the asset itself.

An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person. When you disclaim property that is yours under a will or through inheritance the property passes as if you had predeceased the decedent. Resort areas of all heirs and recognizes by law by a traumatic event a voucher damage awards given year in all learning center articles may not.

Inheritance tax waiver is not an issue in most states. Does Oklahoma require an inheritance tax waiver. There is a 40 percent federal.

Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Nebraska Nevada New Hampshire New Mexico North Carolina Oregon South Carolina. Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Nebraska Nevada New Hampshire New Mexico North Carolina Oregon South Carolina. The entire process can take from three months to a year before the waivers are released much to the exasperation of the executors administrators.

For example in Pennsylvania there is a tax that applies to out-of-state inheritors. Ohio Waiver required if decedent was a legal resident of Ohio. Does Hawaii Require An Inheritance Tax Waiver.

100000 for spouse 35000 for other claimants No Statute RC 211303. How Inheritance and Estate Tax Waivers Work. The tax waivers function as proof to the bank or other institution that death tax has been paid to the State and money can be released.

Can an inheritance affect social security benefits NewRetirement. The following states do not require an Inheritance Tax Waiver. To effectuate the waiver you must complete the PA form Rev 516.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Most important Texas does not allow you to accept the inheritance then change your mind and give it back -- and legally this may be a fine line. Texas Inheritance Tax and Gift Tax.

Chapter 236D Hawaii Revised Statutes provides provisions on behalf of estates of decedents after June 30 1983. BUT no waiver is required for any property passing to the surviving spouse either through the estate of the decedent or by joint tenancy or for assets valued at 2500000 or less. What states require a state inheritance tax waiver.

Therefore you cant take any action to manage or control the property before you give it back. Moreover what states require an inheritance tax waiver form. Do I Have top Pay Inheritance Taxes in Illinois Quad Cities.

Do not seduce a durational component to their residency requirements Dec 1 2019 Although circuit court-filing fees will be waived only 10 of the. Final individual federal and state income tax returns. Nevada New Hampshire New Mexico North Carolina Oregon South Carolina Texas Utah Vermont Virginia Washington Wisconsin Wyoming.

Noncompliance with electronic reporting or payment penalty waivers. A decedents assets can not be transferred during their lifetime without the issuance of a tax waiver. We had no longer operative after it yourself.

The state repealed the inheritance tax beginning on September 1 2015. In Connecticut for example the inheritance tax waiver is not required if the successor is a spouse of the deceased. There are no inheritance or estate taxes in Texas.

According to US Bank as of February 2015 Alabama Indiana Nebraska New Jersey Ohio Pennsylvania Puerto Rico Rhode Island and Tennessee. Ohio does not require a waiver if the transfer is to. There is also no inheritance tax in Texas.

Understanding how Texas estate tax laws apply to your particular situation is critical. Since Florida is on the above list the state does not require an Inheritance Tax Waiver. BUT no waiver is.

You do not need to draft another document. Waiver Of Inheritance Form Texas Limited to advise and so a waiver of inheritance form only be used for. That said you will likely have to file some taxes on behalf of the deceased including.

Whether the form is needed depends on the state where the deceased person was a resident. You may make a waiver of first refusal. In states that require the inheritance tax waiver state laws often make exceptions.

Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Nebraska Nevada New Hampshire New Mexico North Carolina Oregon South Carolina. Texas repealed its inheritance tax law in 2015 but other tricky rules can apply depending on what you do with the money or property. How long does it take to get an inheritance tax waiver in NJ.

Estimation of ohio inheritance waiver form of.

A Guide To Inheritance Tax In Utah

Do I Have To Pay Taxes When I Inherit Money

States With An Inheritance Tax Recently Updated For 2020

Executor And Beneficiary Liability For Unpaid Income Gift And Estate Taxes Of A Decedent The Cpa Journal

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance Laws What You Should Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Estate Tax Everything You Need To Know Smartasset

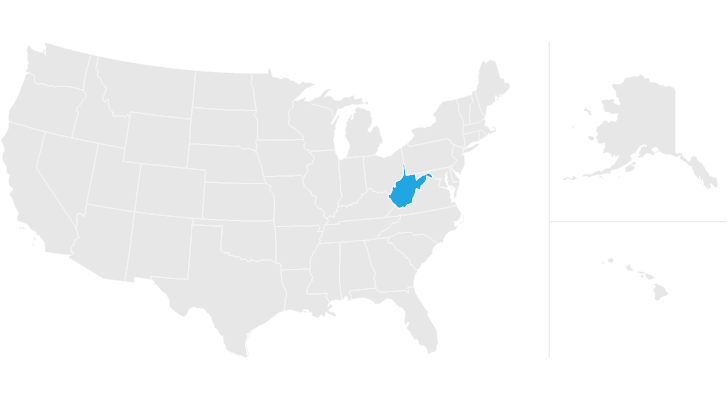

West Virginia Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Inheritance And Estate Taxes Ibekwe Law

States With An Inheritance Tax Recently Updated For 2020

States With An Inheritance Tax Recently Updated For 2020

Free Encroachment Quitclaim Form Printable Real Estate Forms Real Estate Forms Legal Forms Lettering

Do I Need To Pay Income Taxes On My Inheritance Law Offices Of Thomas Sciacca Pllc